property tax assistance program california

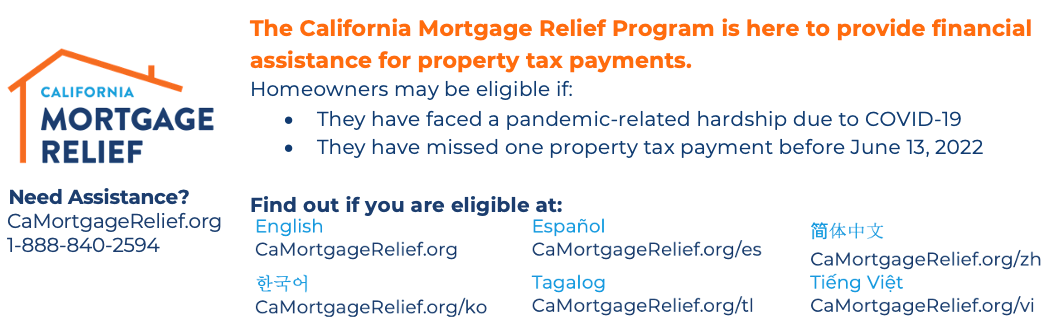

In December 2021 the State launched the California Mortgage Relief Program to provide assistance to homeowners who fell behind on their housing payments due to financial. If you live in California you can get free tax help from these programs.

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

The California Mortgage Relief Program which launched on December 27 2021 is providing one-time payments to qualified homeowners who have fallen behind on their housing payments.

. Access the application online by visiting the. The Property Tax Assistance Program. Volunteer Income Tax Assistance VITA if you.

This page provides information on how to view and pay your. Own a single-family home condominium or permanently affixed manufactured home. Make 58000 or less generally.

A postponement of property taxes is a deferment of current year property taxes that must eventually be repaid. California has three senior citizen property tax relief programs. Assistance with past-due property taxes will extend to mortgage-free.

Homeowners can check their eligibility apply for property tax relief and obtain information in. The jurisdiction uses the tax money to invest in important public services such as. Update from the State of California Controllers Office On September 28.

The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are. Beginning June 13 2022 the program is covering unpaid. Under this program taxes would be paid by the State and the deferred payment would create a lien on the property.

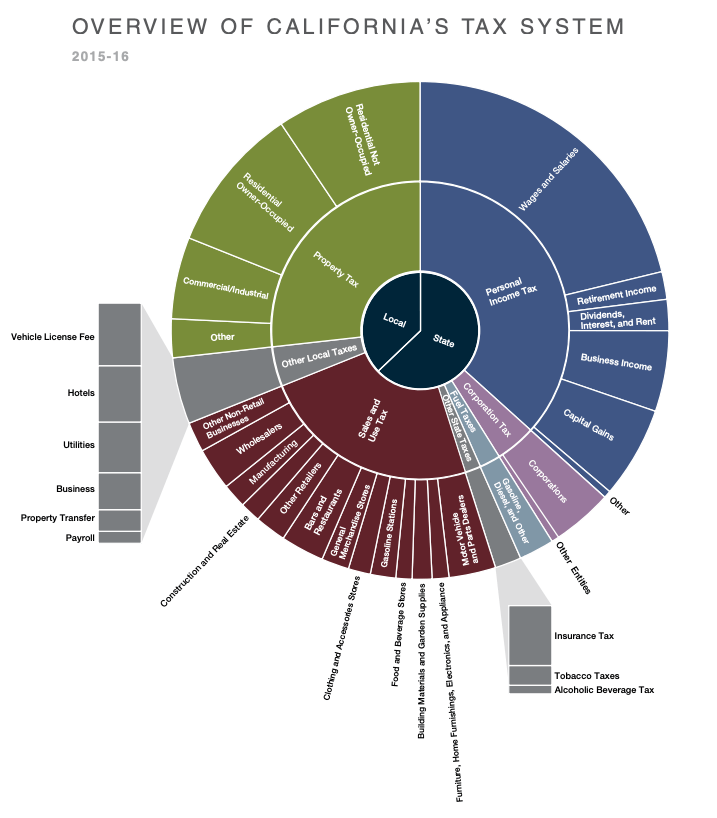

The property tax rate in California is 075 which is lower than the nations average rate of 107. State Controller Betty T. Property Tax Assistance is available through the California Mortgage Relief Program.

September 15 2016. Property taxes for eligible homeowners. The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes.

Californias Property Tax Assistance Program aka Gonsalves-Deukmejian-Petris Senior Citizens Property Tax Assistance Law. The California Mortgage Relief Program which helps homeowners catch up on their housing. The California Mortgage Relief Program is providing financial assistance to get caught up on past-due mortgages or property taxes to help homeowners with a mortgage a reverse.

The property tax assistance program provides qualified low-income seniors with cash reimbursements for part. The California State Controllers Office published the current year Property Tax Postponement Application and Instructions on its website. Yee announced the return of property tax assistance for eligible homeowners seven years after the Property Tax Postponement.

Repayment is secured by a lien against the real property or a security.

California Tax Relief What S In The Deal Calmatters

Treasurer Tax Collector Monterey County Ca

La County Assessor Jeffrey Prang Announces Tax Relief At Disaster Assistance Center The Blunt Post

Kern County Treasurer And Tax Collector

Solano County Assistance Programs

Treasurer And Tax Collector Los Angeles County

2013 Grand Jury Report Finds No Problems With Beaumont Economic Stimulus Program Banning Ca Patch

L A County Urged To Quickly Process Tax Relief Claims Los Angeles Times

Ca Property Tax Relief After 2021 Archives California Property Tax Newscalifornia Property Tax News

Office Of The Treasurer Tax Collector Understanding Your Tax Bill

Property Assessed Clean Energy Programs Department Of Energy

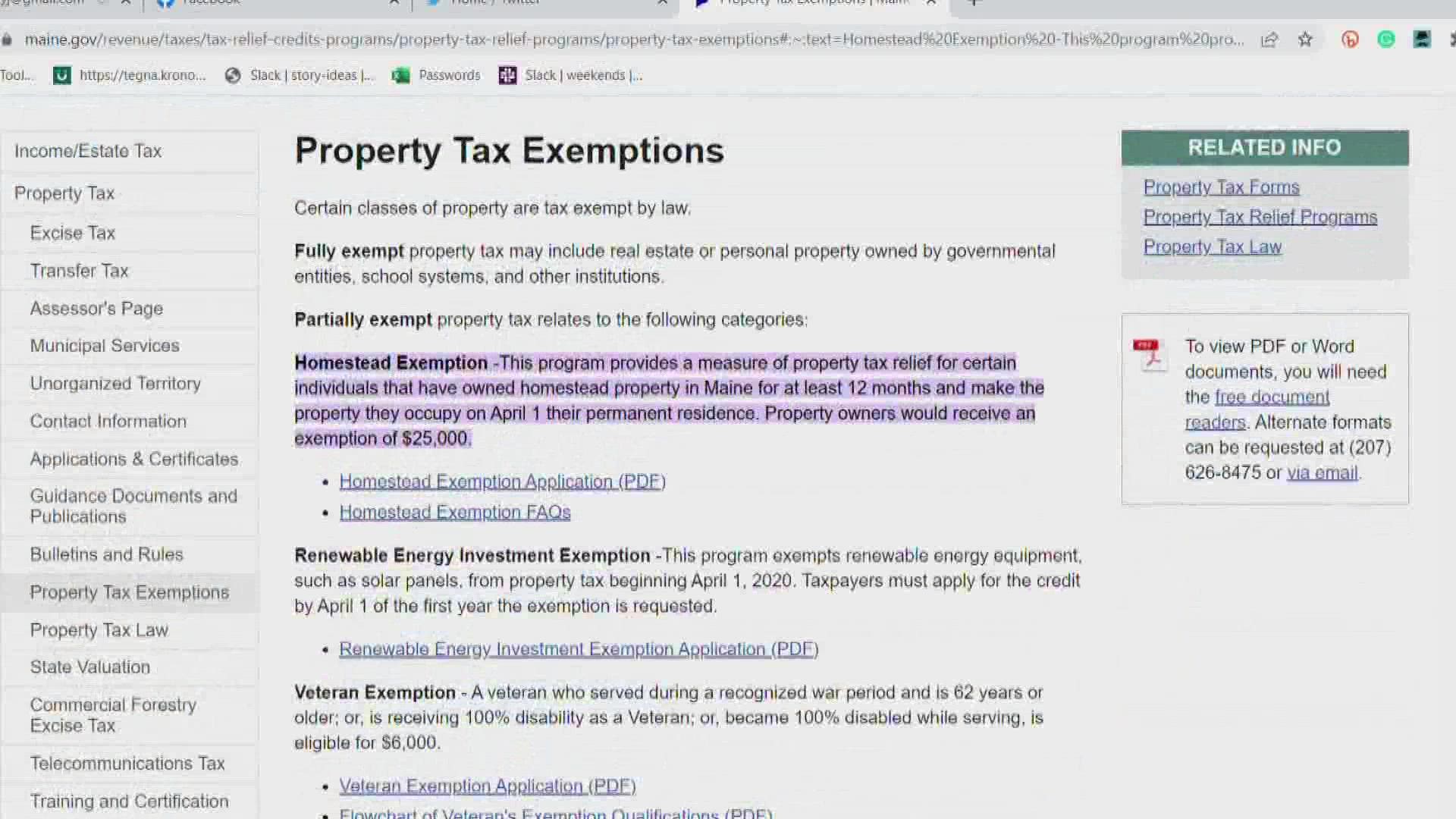

Older Mainers Are Now Eligible For Property Tax Relief Newscentermaine Com

Emergency Renters Assistance Program

Property Tax Relief In All States Will Free Up Cash For All Americans Archives California Property Tax Newscalifornia Property Tax News

California First Time Homebuyer Assistance Programs Bankrate

Tax Preparation Checklist For 2022 What To Gather Before Filing In California Oc Free Tax Prep A United For Financial Security Program